Mumbai, Nov 18th 2024

McKinsey’s recent report, Steering Indian Insurance from Growth to Value in the Upcoming Techade, delves into the dynamic transformation of India’s insurance industry and outlines a roadmap for moving from growth-centric to value-driven strategies. As India advances into its “techade”—a decade marked by accelerated digital adoption—the insurance sector is well-positioned for substantial growth, yet also faces significant challenges.

This is a summary of the key takeaways from McKinsey’s 2024 report on India’s life and general insurance industry.

| About | Description | Key Data Points |

|---|---|---|

| Current Landscape and Growth Potential | India’s insurance industry has shown rapid growth with a CAGR of 11%, surpassing $130 billion in gross written premiums. Health insurance has seen 20% CAGR, yet overall penetration remains low at 4.0%, down from 4.2% in 2022. | CAGR: 11% in premiums, 20% in health; Decline in penetration from 4.2% to 4.0% |

| Regulatory and Competitive Landscape | IRDAI has launched initiatives like Bima Vahak and Bima Sugam, promoting digital transformations and rural outreach. Private players and digital disruptors are enhancing operational efficiency and customer reach. | Bima Vahak, Bima Sugam; Go Digit, Acko as digital disruptors |

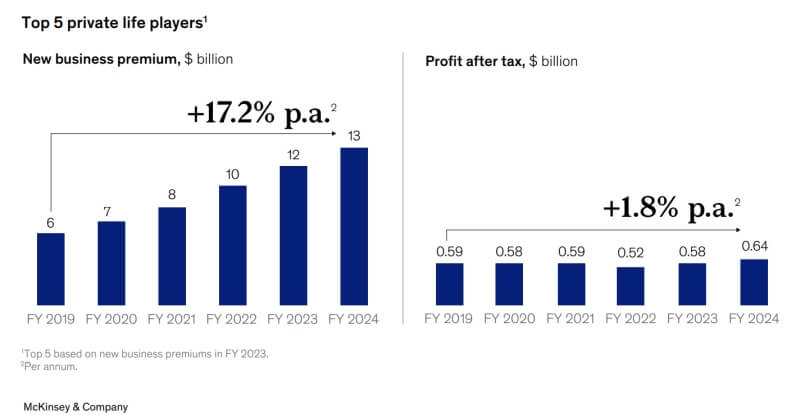

| Key Challenges | Despite growth in premiums, profitability remains a challenge. The top 5 private insurers saw only 2% CAGR in net profit, with operational costs outpacing premium growth. Key challenges include distribution inefficiency and limited innovation. | 2% CAGR in net profit for top 5 insurers; Rising operational costs |

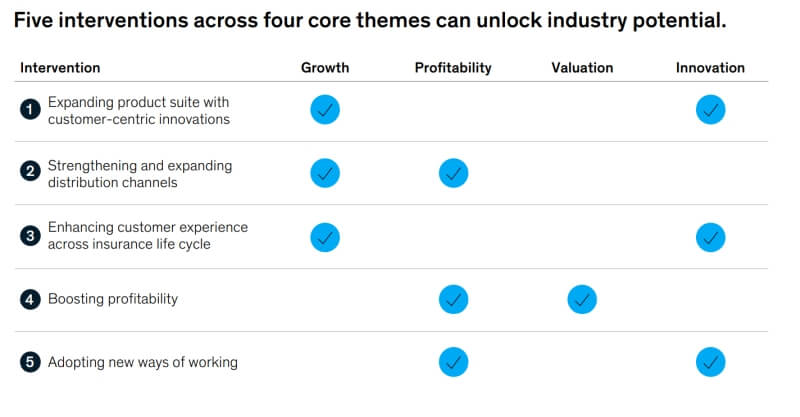

| Strategic Interventions | McKinsey suggests five key interventions: expanding customer-centric products, strengthening distribution channels, improving customer experience, boosting profitability, and adopting agile operational models. | Five interventions: 1.Customer-centric products, 2.Expanded channels, 3.Improved experience, 4.Profitability boost, 5.Agile operations |

| The Road Ahead | The insurance sector is positioned to support India’s economic goals by 2047. Digital transformation and data-driven decisions will enable a future-proof, inclusive financial ecosystem, with a focus on risk management and modular products. | Digital transformation to enhance inclusivity and support economic goals for 2047 |

The Current Insurance Landscape in India and Growth Potential

India’s insurance industry has witnessed rapid growth, underpinned by a burgeoning middle class, rising healthcare costs, and a heightened awareness of insurance benefits post-pandemic. The sector’s gross written premium (GWP) surpassed $130 billion, growing at a compound annual growth rate (CAGR) of 11% from fiscal year 2020 to 2023. Health insurance, in particular, has achieved remarkable growth with a 20% CAGR, positioning it above several Asian counterparts in valuation multiples.

Despite this positive trajectory, McKinsey highlights India’s relatively low insurance penetration rate, which declined from 4.2% in 2022 to 4.0% in 2023, indicating that insurance access hasn’t kept pace with economic growth. This gap reveals an untapped market, especially in rural areas and underserved segments such as MSMEs (micro, small, and medium-sized enterprises), which collectively employ over 110 million people and contribute nearly 30% to the GDP.

Regulatory and Competitive Landscape

The Insurance Regulatory and Development Authority of India (IRDAI) has spearheaded initiatives such as Bima Vahak, which deploys women agents to rural areas, and Bima Sugam, a digital marketplace simplifying policy management. Private players have entered the market with innovations aimed at operational efficiency, digitization, and competition with public incumbents. New entrants like Go Digit and Acko have leveraged AI-based fraud detection, smartphone-enabled inspections, and partnerships for strengthened service.

Key Challenges: Profitability, Operational Efficiency, and Innovation

McKinsey’s report identifies profitability and operational efficiency as significant hurdles. Operational costs, including employee and marketing expenses, have outpaced premium growth. The five largest private insurers in India saw a mere 2% CAGR in net profit over five years, despite a robust 17% growth in new business premiums. Additionally, the report cites inefficiencies in distribution and customer service, which impact profitability and overall growth potential.

Strategic Interventions for Sustainable Growth

To overcome these challenges and unlock value, McKinsey proposes five strategic interventions across growth, profitability, valuation, and innovation:

- Product Expansion with Customer-Centric Innovations: Insurers could adopt agile methods and modular products to swiftly respond to market demands, including multigenerational health plans and OPD (Outpatient Department) coverage-focused products.

- Distribution Channel Expansion: As competition intensifies, insurers need a seamless experience across digital and offline channels. Leveraging partnerships with tech firms to enhance digital distribution can help tap into unserved markets more effectively.

- Enhanced Customer Experience: Insurers should focus on end-to-end improvements, from product discovery to claims processing, ensuring a unified experience. Initiatives such as using analytics for personalized marketing are pivotal.

- Profitability Boost: With cost pressures mounting, McKinsey recommends modernizing outdated infrastructure to reduce expenses, optimize marketing ROI, and streamline operations.

- Adoption of New Operational Models: Moving from traditional silos to agile, cross-functional platforms can improve adaptability, address evolving customer needs, and support rapid product innovation.

The Road Ahead: Digital Transformation and Innovation

India’s insurance industry is poised to play a crucial role in the nation’s economic trajectory by 2047. Achieving sustainable growth will require not only regulatory support but also a shift towards data-driven decision-making, modular product offerings, and enhanced risk management through advanced analytics. Embracing digital transformation, insurers can anticipate consumer needs better, streamline operations, and contribute to a more inclusive financial future for India.

Venkat