ICICI Pru Guaranteed Pension Plan Flexi

ICICI Pru Guaranteed Pension Plan Flexi is designed to provide you with a secure and steady income in your retirement years. This annuity-based retirement plan offers guaranteed, lifelong payments, ensuring peace of mind and financial security in post-retirement life. The plan features several customizable options to suit varying needs, making it ideal for those seeking tailored solutions for retirement planning.

How it works?

Understand ICICI Pru Guaranteed Pension Plan Flexi

| Feature | Description |

|---|---|

| Plan Type | Annuity-based retirement plan |

| Guaranteed Annuity | Lifetime income with a fixed annuity rate, unaffected by market changes |

| Annuity Options | Multiple options, including: Single Life without Return of Premium, Joint Life with Return of Premium, and Critical Illness/Permanent Disability benefit |

| Premium Payment Term | Flexible options from 5 to 15 years |

| Deferment Period | Can be selected at policy inception to delay annuity payments as per the policyholder’s choice |

| Payment Frequency | Annual, Half-yearly, Quarterly, or Monthly |

| Minimum Entry Age | 40 years (Primary Annuitant), 30 years (Secondary Annuitant) |

| Maximum Entry Age | 70 years |

| Minimum Annuity | ₹12,000 per annum (₹1,000 per month) |

| Top-up Option | Available at any time, allowing additional savings beyond the base premium |

| Save the Date Feature | Customize annuity start date to align with a memorable date |

| Death Benefit Options | Lump Sum or Structured Income over five years |

| Waiver of Premium | Available for Joint Life options in case of death of the primary annuitant |

| Loan Facility | Loan against policy available, with a maximum limit of 60% of the surrender value |

| Special Withdrawal | Withdraw up to 60% of total premiums paid during the policy term, with up to three partial withdrawals allowed |

| Guaranteed Additions | Accrued during the deferment period, enhancing the policy’s overall value |

| Surrender Value | Available after payment of one full year’s premium; surrender value calculated based on Guaranteed and Special Surrender Values |

| Tax Benefits | Potential tax benefits on premiums and benefits under prevailing tax laws |

Key Highlights

- Guaranteed Annuity Payments: Enjoy a guaranteed lifetime annuity, allowing you to retire with confidence. The annuity amount is set at the start and does not change over time, ensuring stability in retirement income.

- Flexible Annuity Options: With options that include increasing annuities, joint-life benefits, and critical illness/premium waiver features, you can customize your plan based on your needs and family structure.

- Wide Range of Premium Payment Options: Choose from annual, half-yearly, or monthly payments, allowing you to manage your finances flexibly while building your retirement corpus.

- Top-up Option: This unique feature allows you to increase your retirement savings by adding top-ups when you have additional funds. This flexibility ensures your retirement fund grows over time, even after policy inception.

- Save the Date Feature: You can specify an annuity start date that aligns with a memorable occasion or personal milestone, receiving annuity payments in sync with significant dates in your life.

Annuity Options Available

The ICICI Pru Guaranteed Pension Plan Flexi offers a range of annuity choices to cater to individual needs:

- Single Life without Return of Premium: Suitable for those seeking a steady income for life without the need for a return of premiums upon death.

- Joint Life with Return of Premium: Ensures lifelong income for both primary and secondary annuitants (e.g., spouses). Upon the demise of both, the nominee receives a return of premiums.

- Critical Illness or Permanent Disability Option: An annuity is paid until the first diagnosis of a specified critical illness or permanent disability. If a critical illness occurs, a lump sum is paid out, providing financial support during health-related adversities.

Premium Payment and Deferment Periods

The plan offers a flexible premium payment period from 5 to 15 years, with deferment options allowing you to begin receiving annuities at a time that best fits your retirement timeline.

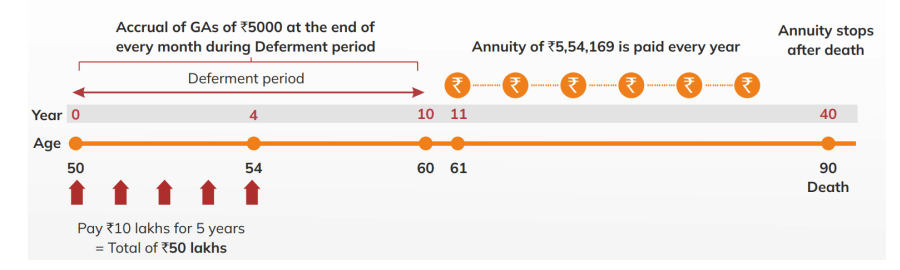

Sample Calculation

For a 50-year-old individual choosing the “Single Life without Return of Premium” option, paying an annual premium of ₹10 lakhs for 5 years with a deferment of 10 years:

- Total Premiums Paid: ₹50 lakhs

- Annual Annuity after Deferment: ₹5,54,169

- Quarterly Annuity: ₹1,35,852

Benefits and Additional Features

- Waiver of Premium for Joint Life: In the case of the primary annuitant’s passing, future premiums are waived for the secondary annuitant.

- Guaranteed Additions: During the deferment period, guaranteed additions accrue monthly, increasing the value of your policy.

- Loan Facility: Policyholders can take a loan against the policy, subject to specific terms, providing liquidity in case of unforeseen expenses.

- Special Withdrawal: Up to 60% of the total premiums paid can be withdrawn during the policy term, should you require emergency funds.

Death Benefit Options

The plan offers various options for death benefit payouts:

- Lump Sum: The death benefit is paid as a lump sum to the nominee.

- Structured Income: The nominee can choose to receive the death benefit as structured payments over five years, ensuring consistent income.

Surrender and Paid-up Policies

If you decide to stop paying premiums after a certain period, the policy enters a paid-up state, offering reduced benefits instead of lapsing. Additionally, surrendering the policy after one full premium payment year can yield a surrender value, though surrendering is generally recommended only if necessary.

Tax Benefits

Policyholders may enjoy tax benefits under prevailing tax laws on both premiums paid and benefits received, making this plan a tax-efficient retirement investment option.

Venkat